Check GST Return Filing Status

Check GST return Filing status for GSTR-1, GSTR-3B or GSTR-4 by entering GST number (GSTIN) below.

Method to Verify GST Return Status

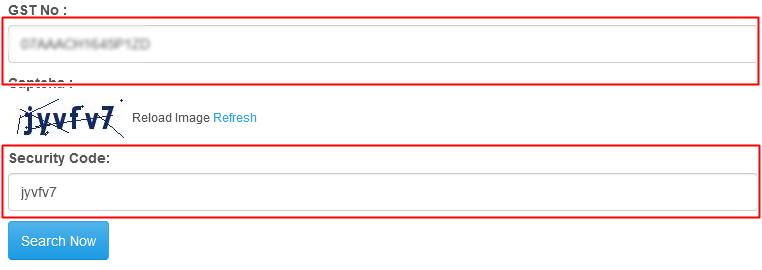

Goto: https://www.gstsearch.in/gst-return-filing-status.html

Input Gst Number than click on search button.

IT will show the details of the GST/GSTIN return filing status.

IT will show the details of the GST/GSTIN return filing status.

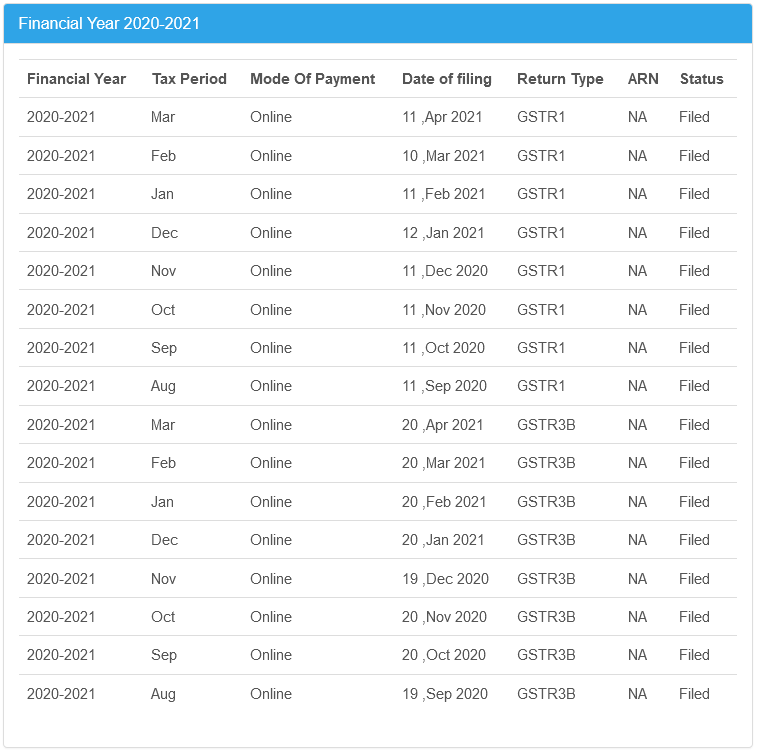

Goods and Services Tax (India) GSTR1 Filling Data 2020-21

| # | Month | Eligibility | Returns Filed | Return Filing % |

|---|---|---|---|---|

| 1 | April | 1,03,96,914 | 24,78,043 | 23.83% |

| 2 | May | 96,02,035 | 21,35,751 | 22.24% |

| 3 | June | 1,03,98,099 | 15,87,579 | 15.27% |

Goods and Services Tax (India) GSTR3B Filling Data 2020-21

| # | Month | Eligibility | Returns Filed | Return Filing % |

|---|---|---|---|---|

| 1 | April | 1,04,14,263 | 71,69,266 | 68.84% |

| 2 | May | 1,03,42,810 | 58,30,428 | 56.37% |

| 3 | June | 1,03,98,099 | 15,92,033 | 15.31% |

Question - Do I still need to file GST return if there is no expense or earning during the last few months?

Answer - In GST every registered Taxpayer needs to file following GST Return Compulsory whether they have a transaction (Sales or purchase) during the month or not.

1.Monthly GSTR - 3B

2. Quarterly GSTR - 1 (if T/o below 1.5Cr)

3. Annual GSTR - 9

You need to File Nil Returns for the period when there were no sales or purchases.

Answer - In GST every registered Taxpayer needs to file following GST Return Compulsory whether they have a transaction (Sales or purchase) during the month or not.

1.Monthly GSTR - 3B

2. Quarterly GSTR - 1 (if T/o below 1.5Cr)

3. Annual GSTR - 9

You need to File Nil Returns for the period when there were no sales or purchases.

Question - What are different Return application status types?

Answer - 1. TO BE FILED : Return due but not filed

2. SUBMITTED BUT NOT FILED: Return Validated but pending filing

3. FILED – VALID: Return Filed

4. FILED - INVALID: Return Filed but tax not paid or short paid