Jammu Kashmir GSTIN/UIN Search India

Jammu Kashmir GSTIN/UIN Search India, Just type your GSTIN/UIN number below and check name and address of the GSTIN/UIN holder.

GST Number Search Tool allow to verify any GSTIN with a single-click GSTIN search.

Goods and Services Tax Identification Number or simply "GSTIN" is your unique business identity, consisting of 15 digits.

What is Goods and Services Tax (GST)?

GST stands for “Goods and Services Tax” (GST) is an indirect tax (or consumption tax) used in India on the supply of goods and services.

It is a comprehensive, multistage, destination-based tax: comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Multi-staged as it is, the GST is imposed at every step in the production process, but is meant to be refunded to all parties in the various stages of production other than the final consumer and as a destination-based tax, it is collected from point of consumption and not point of origin like previous taxes.

Goods and services are divided into five different tax slabs for collection of tax: 0%, 5%, 12%, 18% and 28%. However, petroleum products, alcoholic drinks, and electricity are not taxed under GST and instead are taxed separately by the individual state governments, as per the previous tax system.

There is a special rate of 0.25% on rough precious and semi-precious stones and 3% on gold.

In addition a cess of 22% or other rates on top of 28% GST applies on few items like aerated drinks, luxury cars and tobacco products.

Pre-GST, the statutory tax rate for most goods was about 26.5%, Post-GST, most goods are expected to be in the 18% tax range.

What are the uses of GSTIN?

GSTIN is one of the pre-requisites for starting a business. As per the GST law, GSTIN has to be displayed at all places of businesses of a registered individual. Also, it has to be quoted during the process of raising invoices, while generating e-way bills, during GST return filing, and during the submission of information to the tax department.

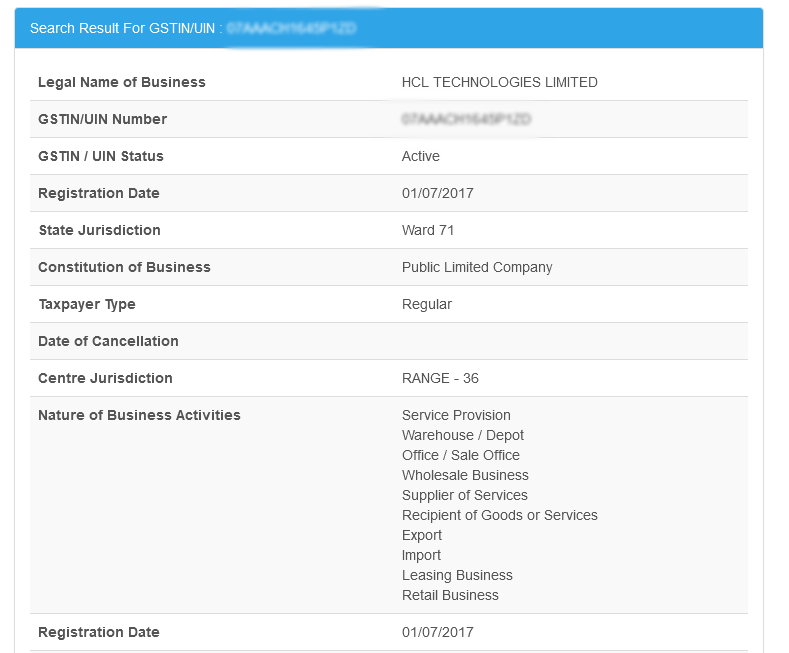

How to use the GST Number Search Tool?

Enter Your 15 Digit GSTIN number in the search box below

Click on “Search” button

If the GSTIN is correct, the details that can be verified here are-

1. Verify GST Number

2. Registered Business Address

3. Name of Business

4. Nature of Business

5. Date of Registration

6. Check GST Return Status

7. Type of Taxpayer - Composition or Regular

8. GST Active or Inactive

9. Constitution of Business

10. Jurisdiction State, etc.

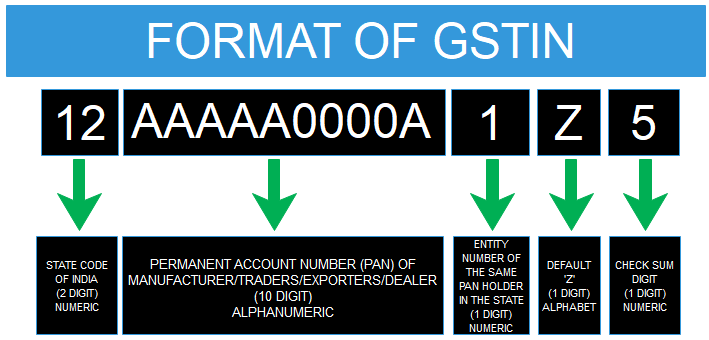

Format of GST/GSTIN number.

First 2 numbers → State code of the registered person

Next 10 characters → PAN of the registered person

Next number→ Entity number of the same PAN

Next character → Alphabet Z by default

Last number → Check code which may be alpha or digit, used for detection of errors

| Normal Taxpayers | 85,263 |

| Composition Taxpayers | 8,559 |

| Input Service Distributor | 23 |

| Casual Taxpayers | 2 |

| Tax Collector at source | 120 |

| Tax Deductor at source | 1,656 |

| UIN Holders | 10 |

| Total | 95,633 |

Goods and Services Tax (India) Revenue Collections Jammu and Kashmir 2020-21

| # | Month | Collections | Monthly Changes |

|---|---|---|---|

| 1 | April | NA | No Change |

| 2 | May | NA | No Change |

| 3 | June | ₹325 crore | No Change |

| 4 | July | ₹298 crore | ▼ |

| 5 | August | ₹326 crore | ▲ |

| 6 | September | ₹368 crore | ▲ |

| 7 | October | ₹377 crore | ▲ |

| 8 | November | ₹360 crore | ▼ |

| 9 | December | ₹318 crore | ▼ |

| 10 | January | NA | No Change |

| 11 | February | ₹329.89 crore | No Change |

| 12 | March | ₹351.61 crore | ▲ |